Heloc dti calculation

The first requirement is having enough home equity to qualify for a HELOC. To calculate your debt-to-income ratio add up all of your monthly debts rent or mortgage payments student loans personal loans auto loans credit card payments child support.

Home Equity Line Of Credit Heloc Rocket Mortgage

If you do not use a combination mortgage.

. This leaves me with only 260. Add the expected monthly payment of your home equity loan HEL to the total. Debt-To-Income DTI Ratio Calculation Questions.

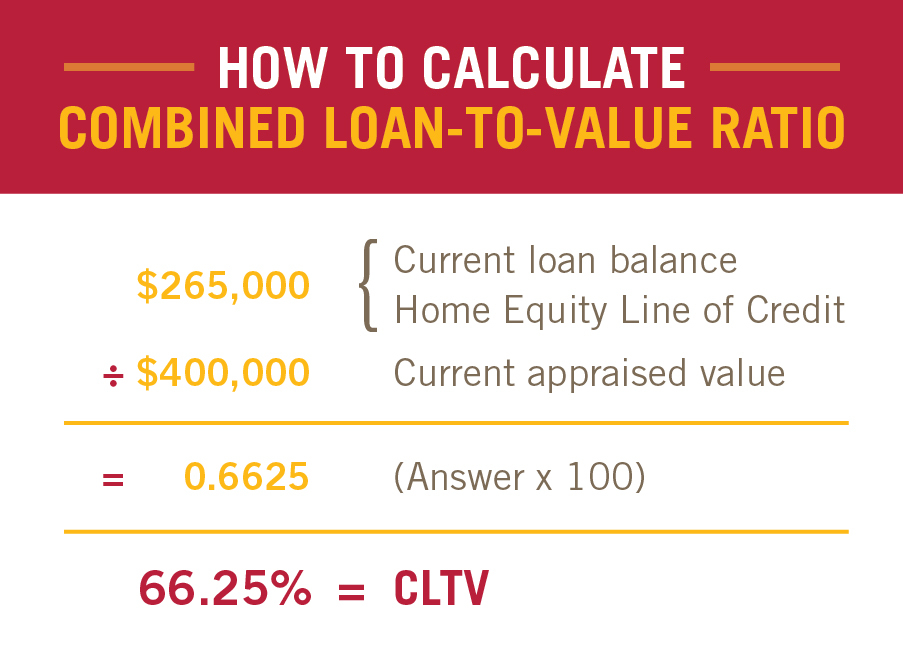

Your home equity is the current market value of your house minus what you owe on your mortgage and any other. If so this will be 3910 max for all expenses. If you want to apply for a 65000 HELOC with a 200000 mortgage loan balance you would calculate your CLTV like this.

My primary housing payment will be 2600. Your debt-to-income DTI ratio and credit history are two important financial health factors lenders consider when determining if they will lend you. Problem is I have 2 car loans totalling almost 1000mo.

What is a Debt-to-Income Ratio. Maximum HELOC Amount is up to 65 of homes market value. Keeping that in mind some loan amounts or products.

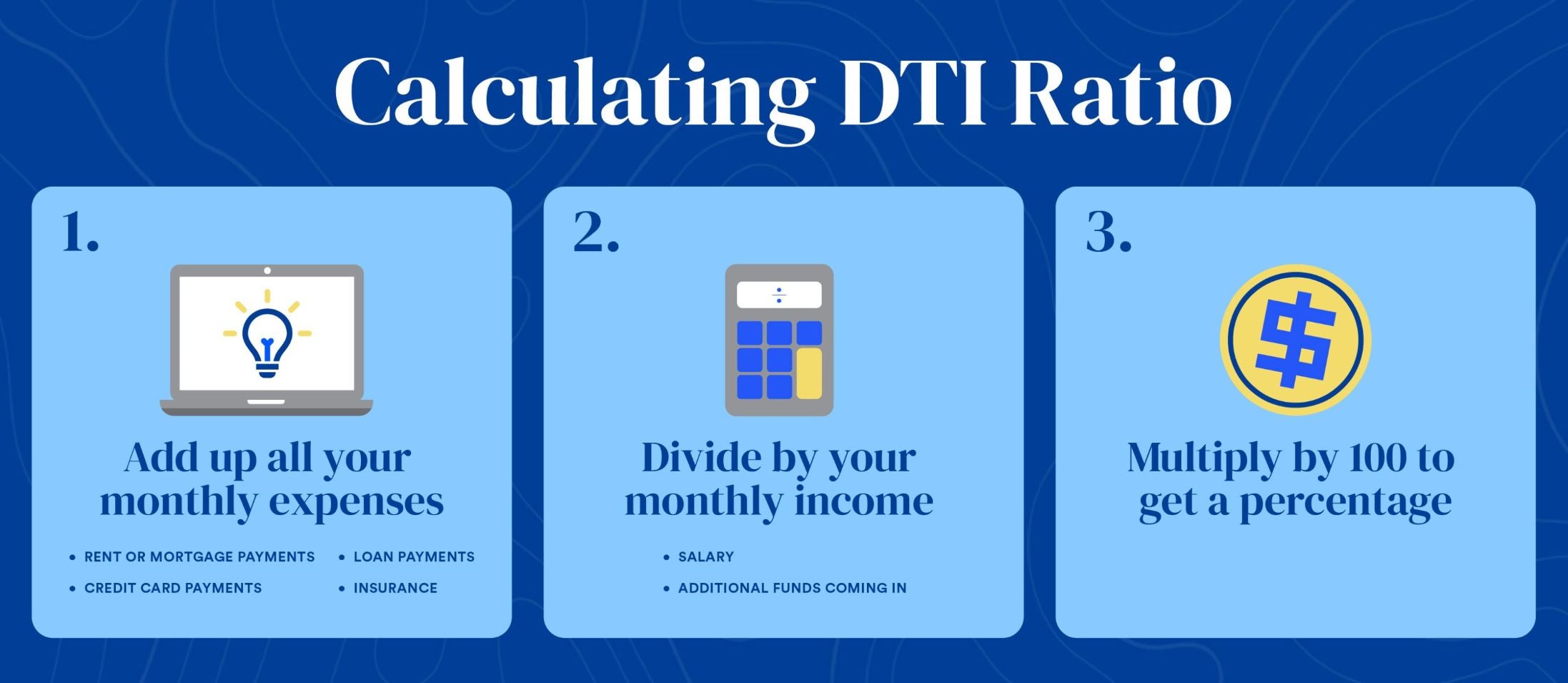

Qualifying DTIs depend on the loan product and principal amount but a DTI ratio of less than 36 is the most-used figure. Debt-to-income ratio DTI is the ratio of total debt payments divided by gross income before tax expressed as a percentage usually on either a monthly or. The current average 10-year HELOC rate is 611 but within the last 52 weeks its gone as low as 255 and as high as 611.

2 days agoThis generally causes HELOC rates to move up. Home Value x 80 Mortgage Balance. If you have a desired loan amount in mind use Discover Home Loans monthly payment calculator to get an.

These include taking a home equity line of credit HELOC a home equity loan HEL. Having good credit can also qualify you. To calculate your back-end DTI ratio you can use the following formula below.

This document provides data entry guidance to ensure DU includes all applicable debts and income in the Debt-to-Income DTI Ratio. When you apply for a home equity loan lenders will look at your debt-to-income DTI ratio as one measure of your ability to repay. Total loan balances secured by your home HELOC amount.

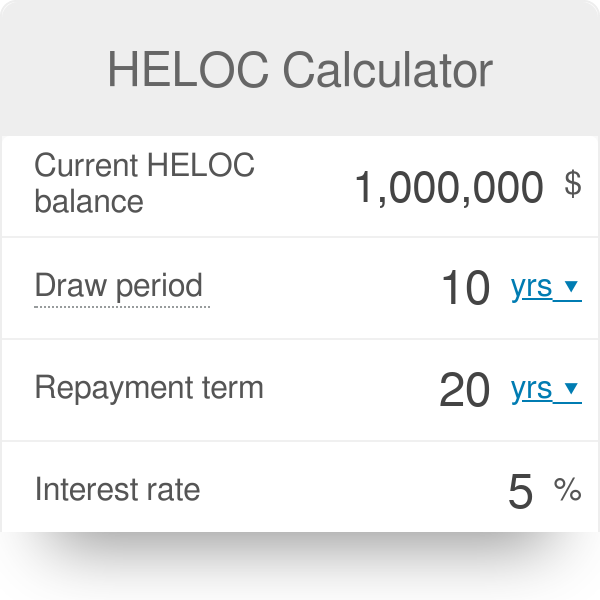

This HELOC calculator is designed to help you quickly and easily calculate your monthly HELOC payment per your loan term current interest rate and remaining balance. To get approved for a HELOC your credit score should fall in the mid-to-high 600sthough a score of 700 or higher is even better. Your debt-to-income ratio compares all of.

Use our home equity line of credit HELOC payoff calculator to find out how much you would owe on your home equity-based line each month depending on different variables.

Heloc Calculator

The Homeowner S Guide To Home Equity Loans And Lines Of Credit

What Is The Debt To Income Ratio Learn More Citizens Bank

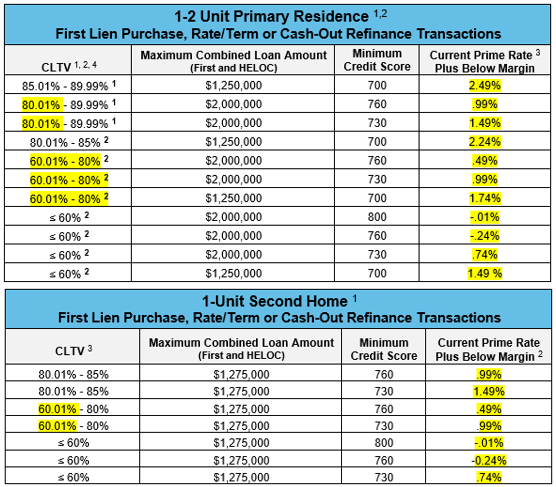

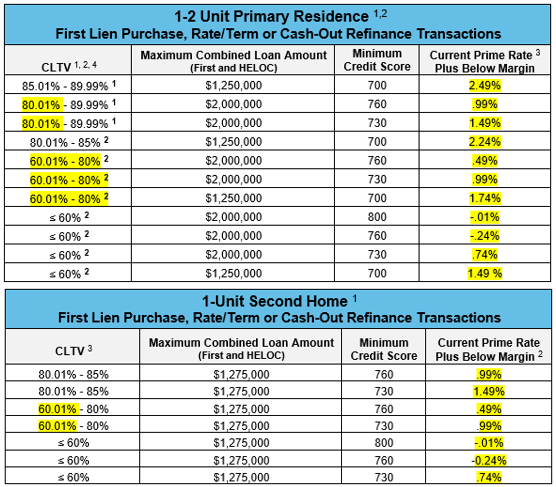

Heloc Program Margin And Guideline Updates Homebridge Wholesale

How To Calculate Your Home Equity Finder Com

The Homeowner S Guide To Home Equity Loans And Lines Of Credit

Home Equity Line Of Credit Heloc Rocket Mortgage

What Is Debt To Income Ratio Dti And Why Does It Matter Nextadvisor With Time

Heloc Requirements And How To Qualify Credello

Requirements For A Home Equity Line Of Credit Heloc Uccu

Home Equity Line Of Credit Heloc Macu

What Underwriters Look At Heloc Requirements And Eligibility Pointers

How To Calculate Debt To Income Ratio

Home Equity Line Of Credit Heloc Rocket Mortgage

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

Home Equity Line Of Credit Heloc Rocket Mortgage

Home Equity Line Of Credit Qualification Calculator